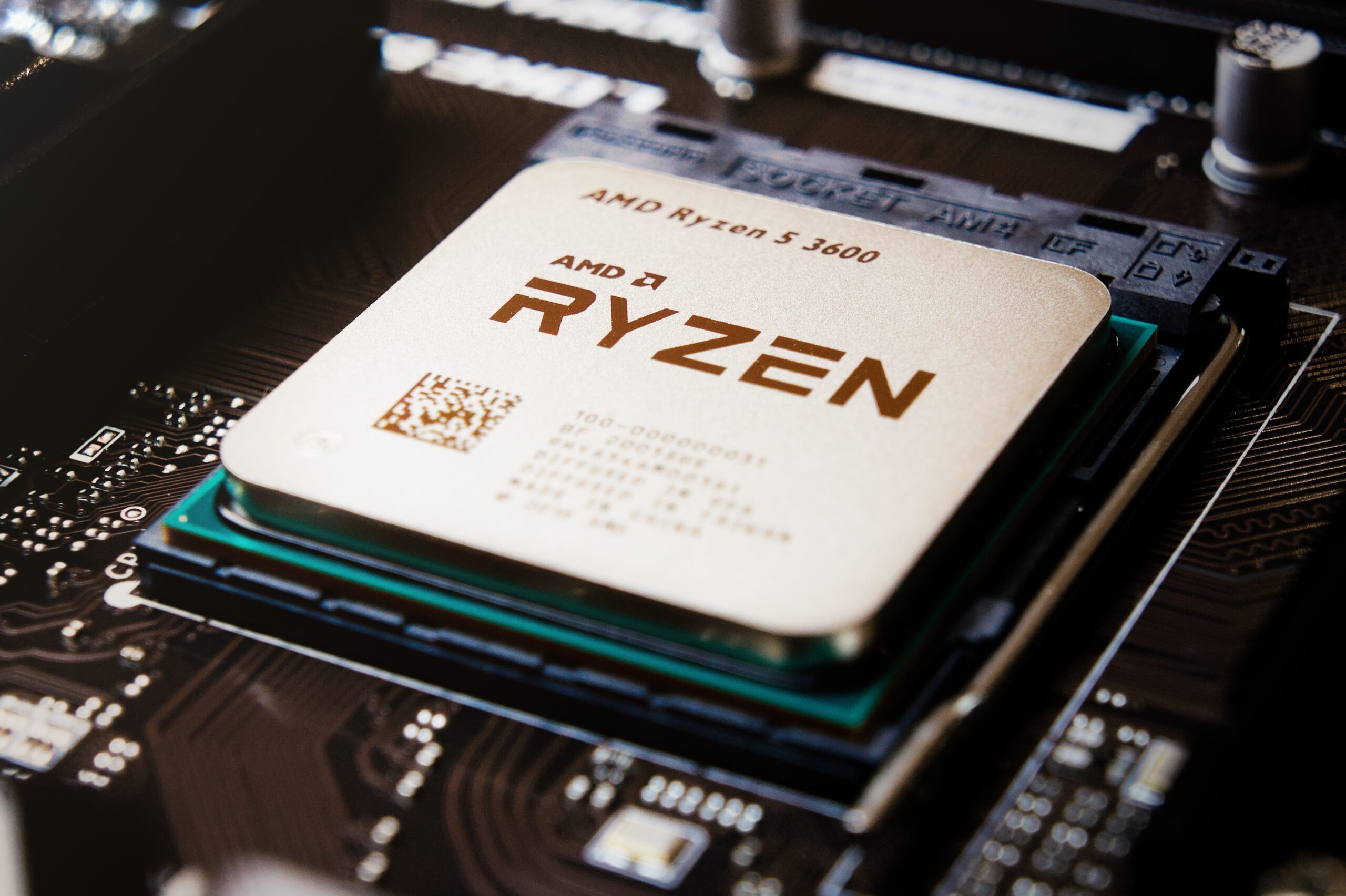

Advanced Micro Devices, Inc. (AMD) is an American multinational semiconductor company that designs and manufactures a wide range of computer processors, graphics processing units (GPUs), and related technologies. Over the years, it has gone through several transformations and shifts in its product focus. Initially, it started as a second-source manufacturer for Intel’s microprocessors and then expanded into its own CPU and GPU designs, AMD is well-known for its CPU products. The AMD Ryzen series of desktop processors and AMD EPYC series of server processors have gained popularity for their competitive performance and pricing compared to Intel’s offerings. AMD’s CPUs are based on the Zen architecture, which has undergone multiple iterations, including Zen, Zen+, Zen 2, Zen 3, and Zen 4. Making series like AMD Ryzen 5 massive hits, due to its huge impact in the chip industry AMD stock could be a good investment in 2024.

AMD is also a major player in the GPU market. Its Radeon graphics cards compete with Nvidia’s GeForce series. AMD’s Accelerated Processing Units combine CPU and GPU cores on a single chip.

AMD had been gaining market share in both the CPU and GPU markets. It had a particularly strong presence in the consumer and gaming segments.

Fundamental Analysis Of AMD Stock.

Looking at AMD stock’s historical revenue and earnings growth over the past several quarters or years. Consistent and robust growth is often a positive sign. This growth was primarily driven by strong demand for its Ryzen CPUs and Radeon GPUs. AMD’s gross profit margin had been improving, reflecting efficient manufacturing and product pricing. Operating margin and net profit margin had also been expanding, indicating improved profitability.

AMD had a relatively strong balance sheet with increasing total assets whereas liabilities had also been growing as well but were generally manageable in relation to assets. AMD stock had a moderate level of debt, with a reasonable debt-to-equity ratio. AMD’s price-to-earnings (P/E) ratio had been relatively high compared to historical averages, indicating that investors were willing to pay a premium for the company’s growth prospects. AMD stock had been gaining market share in the CPU and GPU markets, competing effectively against Intel and Nvidia, respectively. Thats why AMD stock according to us is a good investment to make.

AMD EARNINGS 2024 ANALYSIS

Analyzing the consolidated AMD Cash Flow Statement from 2009-2024 reveals a noteworthy trend. Earnings showed a significant incline starting from 2017, peaking in 2022 but experiencing a dip in 2023. However, based on fundamental analysis and current market conditions, the outlook for AMD earnings in 2024 appears positive and promising.

Please refer this balance sheet for further clarity.

AMD Vs NVIDIA

The GPU market as of now is unevenly split between the two giants with Nvidia holding a dominant position due to better brand recognition. That said, despite lower revenue, AMD’s excellent graphics cards make it a really worthy alternative to Nvidia for investment.

In this AI driven Era, Nvidia collaborated with AMD by using thousands of 64 Core high performance processors in super computers. AMD’s EPYC microchip outperformed Intel’s Xeon Scalable processors by a long shot leading to a successful partnership.

Nvidia’s stock followed an upward trend of 214% in 2023, making AMD’s 72% gains feel nothing compared to Nvidia’s, this led to higher valuations for Nvidia, trading at 41-times forward earnings and 45-times sales, compared to AMD’s 26-times earnings and 8-times sales metrics.

But from a valuation perspective, in our opinion it’s clear that AMD stock is more attractive, at least right now. Nvidia is already trading at it’s all time high and has already given 3x returns which is a lot higher than Nasdaq CAGR.

So finally a million dollar question is AMD a good stock investment. ? After discussing all the points and fundamental analysis we do feel AMD stock is a good investment in 2024.

What Now

Predicting the performance of a company’s stock is a complex task and depends on a multitude of factors that can change over time. The success of AMD’s future product releases, including CPUs and GPUs, will play a significant role in its performance we should be watching for innovations, performance improvements, and market competitiveness.

AMD’s performance is closely tied to demand in key markets, such as gaming, data centres, and cloud computing. Trends in these markets can impact the company’s revenue and earnings. It’s essential to stay updated on the company’s financial reports, product roadmaps, industry trends or developments related to the company. Consulting with financial advisors and conducting thorough research can help you assess the company’s prospects and potential risks.

Considering the huge competition in the chip industry. Please research a bit into Nvidia also, we have a nice article to share our views on Nvidia.